The real estate, construction, and facilities management sectors stand at a crossroads. The built environment, a major greenhouse gas emitter, faces scrutiny. Companies now must report climate matters due to mounting pressure.

Deciding what and how to report is complex due to imminent regulations and voluntary frameworks.

Despite the confusion of numerous standards, frameworks, and certifications, they provide data consistency. These tools help evaluate companies’ climate risk and performance. In this article, we’ll explore these tools, mainly those applicable in the US and Canada.

Demand for Climate Reporting – An Investor Push

Although the specific regulations may not apply directly to a lot of companies in this space, there has been a push for more rules and regulations around climate and sustainability for the financial sector, as well as a push for regulations to have clear and consistent data to make investment decisions from.

In the US, the Securities Exchange Council recently adopted a new rule for ESG-labelled funds requiring them to invest 80% in alignment with the theme. Hefty fines could be imposed if authorities find misalignment in the data used to evaluate companies.

At the end of the 2024 fiscal year, some banks and insurers in Canada will need to “conduct stress testing to assess the potential impact of climate change on their risk management and governance strategies” under the Office of the Superintendent of Financial Institutions’ regulation B-15. “Larger institutions must also disclose their annual Scope 1 and 2 greenhouse gas emissions, with Scope 3 numbers to follow by the end of 2025.”

Regulations and rules similar to these are becoming more common around the globe. Again, while they may not apply directly to every company, they demand the ability for transparent, accurate, and comparable information to be provided to the financial sector to manage risk and avoid fines. As well, they signal incoming regulations in this space that will be mandatory and apply to publically traded companies at the very least.

Certifications and Assessments

Sustainability certifications and assessments are verified by a 3rd party and vary in their popularity and use. There are many out there, and understanding the differences and what they would add to your reporting is important.

Green Building Certifications

Green building or sustainable building certifications assess buildings and recognize those that are meeting sustainability standards or requirements. Although there are many globally, some of the most recognized ones include LEED, WELL, BREEAM, and BOMA Best in North America.

The purpose, show how your property is performing sustainability-wise in a verifiable way. Not only are you reducing the environmental impact of your buildings, but you are also likely to have increased property value and lower operations and maintenance costs.

GRESB Assessment

The Global Real Estate Sustainability Benchmark (GRESB) is a common assessment in the real estate industry. “In 2022, over 1,820 property companies, REITs, funds, and developers with USD 6.9 trillion in assets participated, covering 150,000+ assets across 74 countries.” The main focus – providing investors in this space with ESG data that is standardized to manage risks and uncover opportunities.

It evaluates three components :

- Management – measures strategy and leadership management, policies and processes, risk management, and stakeholder engagement approach

- Performance – the assets portfolio performance

- Development – efforts to address ESG issues in the design, construction, and renovation of buildings

The popularity of this assessment allows for benchmarking and rating companies’ performance on sustainability matters. It is also beneficial to companies reporting that it aligns with other globally recognized frameworks and regulations, like GRI and SFDR. Some may even be asked by potential lenders or investors if they are reporting to GRESB as it is common across the industry. Still, this assessment is voluntary, although beneficial for companies in the real estate sector focused on reporting to specific stakeholders.

CDP

CDP, formally the Carbon Disclosure Project, “runs a global disclosure system for investors, companies, cities, states, and regions to manage their environmental impacts”. Companies fill out an assessment annually in which they disclose data according to three categories (climate change, water, and forests), and receive a score to rate their efforts (F – A). This is yet another way for companies to quantify their environmental impact and display it in a commonly accepted format for stakeholders to understand while also being able to benchmark against peers.

Voluntary Reporting Standards and Frameworks

There are a variety of frameworks and standards that companies are currently reporting to document their sustainability or climate efforts. While much of this is voluntary in Canada and the US as wider regulations have not yet come into place, there are some common ones that many companies may choose to report to support their own reporting efforts and meet the needs of other stakeholders. Reporting to these may make you more attractive when looking for investors and capital

GRI

The Global Reporting Initiative (GRI) is “used by more than 10,000 organizations in over 100 countries, the Standards are advancing the practice of sustainability reporting, and enabling organizations and their stakeholders to take action that creates economic, environmental, and social benefits for everyone.” It is currently the most widely used sustainability reporting Standard globally.

The Standards seek to provide transparency into how an organization plans to or is contributing to sustainable development. Standards vary by sector, as well as having general Standards for all companies.

GRI is also complementary to the IFRS S1 & S2 and has also been helpful for preparing those reporting to the new European regulations. Why would you report to multiple? Different frameworks or standards have different audiences in mind and cover a wider array of topics. GRI for example doesn’t just have an investor focus but appeals to a wider range of stakeholder audiences.

IFRS S1 & S2 and SASB

This year the International Sustainability Standards Board (ISSB) released the inaugural IFRS sustainability standards – the IFRS S1 & S2. They take into account the TCFD recommendations which have been consolidated under them.

“IFRS S1 provides a set of disclosure requirements designed to enable companies to communicate to investors about the sustainability-related risks and opportunities they face over the short, medium, and long term. IFRS S2 sets out specific climate-related disclosures and is designed to be used with IFRS S1. ”

These standards set out to create a global baseline for sustainability-related disclosures and have been receiving a lot of recognition from regulatory bodies, expect to see more regulations coming from these inaugural standards in different jurisdictions. As more standards are set to be released and encompass more sustainability-related risks, they will use the Sustainability Accounting Standards Board Standards (SASB) to guide them. Disclosing to the S1 & S2 as well as SASB will put your company in the perfect position for reporting to future ISSB Standards as well as mandatory regulations (more on this below).

SDGs and SBTi

The UN Sustainable Development Goals (UN SDGs) are 17 internationally agreed-upon goals at the heart of the 2030 Agenda for Sustainable Development. While they are used to track international progress by the Member States for a more sustainable future, a lot of businesses have taken to using the goals in their own way to communicate progress.

Since these goals are internationally recognized they can be a great way to benchmark your impact on a larger scale and communicate your own progress on certain goals to different types of stakeholders.

As well, some companies are setting Science Based Targets, which can be developed and accredited with the help of SBTi. Science Based Targets “are considered ‘science-based’ if they are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to 1.5°C above pre-industrial levels”. This is another way for companies to work towards international agreements and set targets to help aid society in getting where they need to be. This is particularly important for high-emitting sectors, such as the buildings sector.

Current Regulations

Due to the nature of the building sector, there may be specific regulations by city, province, or state that you need to adhere to.

In New York City, Local Law 97 requires “most buildings over 25,000 square feet will be required to meet new energy efficiency and greenhouse gas emissions limits by 2024, with stricter limits coming into effect in 2030.” It aims to reduce emissions from the largest buildings in the city by 40% by 2030 and 80% by 2050.

Similar laws and emissions reduction strategies have come into effect in Boston and Toronto. Overall, you must ensure you are aware of the regulations based on where your properties are located geographically. Starting to track emissions now can help when more regulations come into place.

Incoming Regulations

The days of voluntary climate reporting may soon come to an end. Expected dates of incoming regulations are starting to be within reach.

In Canada, the Canada Securities Administrators (CSA) proposed a new regulation, 51-107 Disclosure of Climate-related Matters, in 2021. The regulation initially proposed disclosure of climate risks for public companies, based on TCFD recommendations. Now, it might align with IFRS S1 & S2 standards as they now encompass the TCFD. Especially as it has been endorsed by the International Organization of Securities Commissions.

In the US, things are moving a bit quicker for national regulations by the US SEC. In March 2022, they announced a proposed rule that would require companies to report on greenhouse gas emissions and a variety of climate-related disclosures. This is set to include Scope 1 and 2 emissions reporting with Scope 3 being required under certain conditions. It is expected that the new disclosure requirements will be announced in October 2023 with reporting beginning as soon as 2024. This date has been pushed back before so keep an eye out for changes to the new disclosures! In California, mandatory emissions reporting is expected by 2026, this would mean companies would need to report their full inventory (including Scope 3).

Of course, if your company has global activities, see if more regulations apply. The European Union has been leading the way in regulations, and yes if you conduct business there you may be obligated to report.

Where to Start

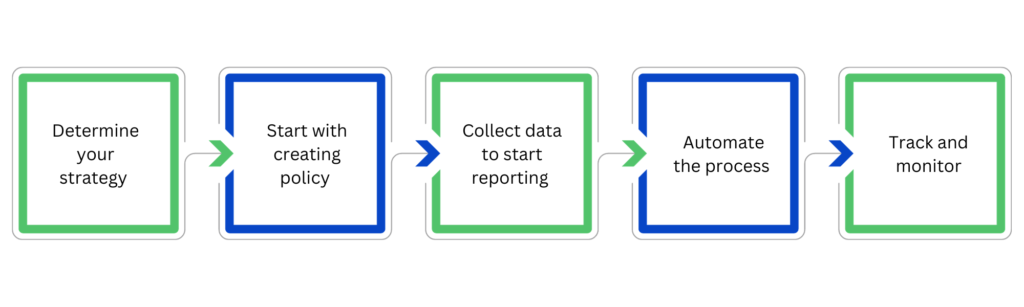

The reporting landscape is complicated at best. If you haven’t started reporting yet or are readjusting it can be quite overwhelming. Follow these steps to ease the process a bit.

Determine Your Strategy

The strategy sets the stage for climate reporting. Before you can report, you need to determine which frameworks or standards you will be reporting to. Governance should be the focus here. How are you going to report? Who is responsible for climate reporting? Are you communicating this with your stakeholders effectively? There is a lot of data that goes into these types of reporting initiatives, what is your data governance strategy?

Before you can report, you also need to understand what you want out of it – do you have certain goals or targets you are expected to reach? Are there expected mandatory regulations that you will need to prepare to disclose? Can you start reporting to different standards or frameworks to prepare yourself for mandatory disclosures?

Focus on your governance and your overall strategy first to set yourself up for success.

Start With Creating Policies

Although it may not be a cornerstone of your reporting, it goes along with governance. You need to be able to build your strategy into your business. Starting with policy can do this by straightening out your governance in this space and enabling your company to achieve what you are striving for. It is like checking the box to start the hard work you are about to do down the line.

Collect Data to Start Reporting

Climate reporting is extremely data-intensive. Your data governance strategy will be important when you start the reporting process. You want to ensure the data you are using is accurate and transparent.

Automate the Process

There are many tools out there that can help with the overwhelming processes. Many companies use Excel to complete reporting, but at a certain point, this becomes difficult.

Depending on the size of your company, where the data lies within your company, the amount of calculations that need to be done, and the number of people working on these projects it can become difficult. As well, with data gathered and transformed manually, you may end up with low-quality or inaccurate data in the end.

ScriptString helps with this by automating the reporting process. With the power of AI, we seamlessly integrate data with real-time tracking and monitoring. Know how you are performing today instead of just when the climate report is due!

Track and Monitor

While incoming regulations motivate this work, there can be other benefits for the company as well.

Even though doing good for the world is up there, for many that is not the key motivator.

Doing good for your business, however, sounds more appealing to most.

Tracking, monitoring, and reporting your climate impacts can help you manage climate risks and lower your operations costs. This will save you money, and might even open new avenues for profits down the line.

In Summary – Navigating Climate Reporting in the Building Sector

In exploring building sector climate measures, we find their vital role in sustainability. Businesses must reduce emissions, benefiting both financially and environmentally. For guidance, prioritize your strategy and consult ScriptString.